Corporate Transparency Act Hub

Summary

Welcome to the Hahn Loeser CTA Hub, a central location to quickly find current and relevant information regarding the Corporate Transparency Act. The Corporate Transparency Act impacts most privately owned businesses, and may impact real estate deals, construction engagements, estate planning for business owners, labor and employment agreements and litigation.

What is the CTA?

The Corporate Transparency Act is federal legislation taking effect on January 1, 2024 that will impact most privately owned businesses. It requires certain beneficial ownership information pertaining to such privately owned companies be reported to the U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN).

Who is subject to the CTA?

Most privately owned businesses will be subject to the CTA. Owners of privately owned businesses should consult with their attorney promptly to discuss the CTA and its impact on their business.

More information is available at the following links:

Corporate Transparency Act Hub Professionals

-

Business Owners Face New Federal Reporting Requirements (Southwest Florida Business Today)February 21, 2024

-

New Year Brings New Federal Reporting Requirements Under the Corporate Transparency Act (Adverse Witness)February 13, 2024

-

Corporate Transparency Act Tax RoundtableFebruary 08, 2024

-

Beware! Corporate Transparency Act Scams Target Business OwnersJanuary 19, 2024

-

Businesses Should Start Preparing for the CTA NowDecember 18, 2023

-

Beneficial Ownership Requirements in the Upcoming Corporate Transparency Act (Buckeye Talks)November 15, 2023

-

Business Owners to Face New Federal Reporting Obligations Under the Corporate Transparency Act in 2024November 07, 2023

-

The Corporate Transparency Act to Take Effect: What Business Owners Need to KnowOctober 20, 2023

FAQs About the CTA

What is the Corporate Transparency Act (CTA)?

The Corporate Transparency Act (the “CTA”) is new federal legislation codified as 31 U.S.C. §5336, that requires most privately owned companies to disclose Beneficial Ownership Information (“BOI”) to the Financial Crimes Enforcement Network (“FinCEN”) of the United States Treasury.

What Entities Are Subject to the CTA?

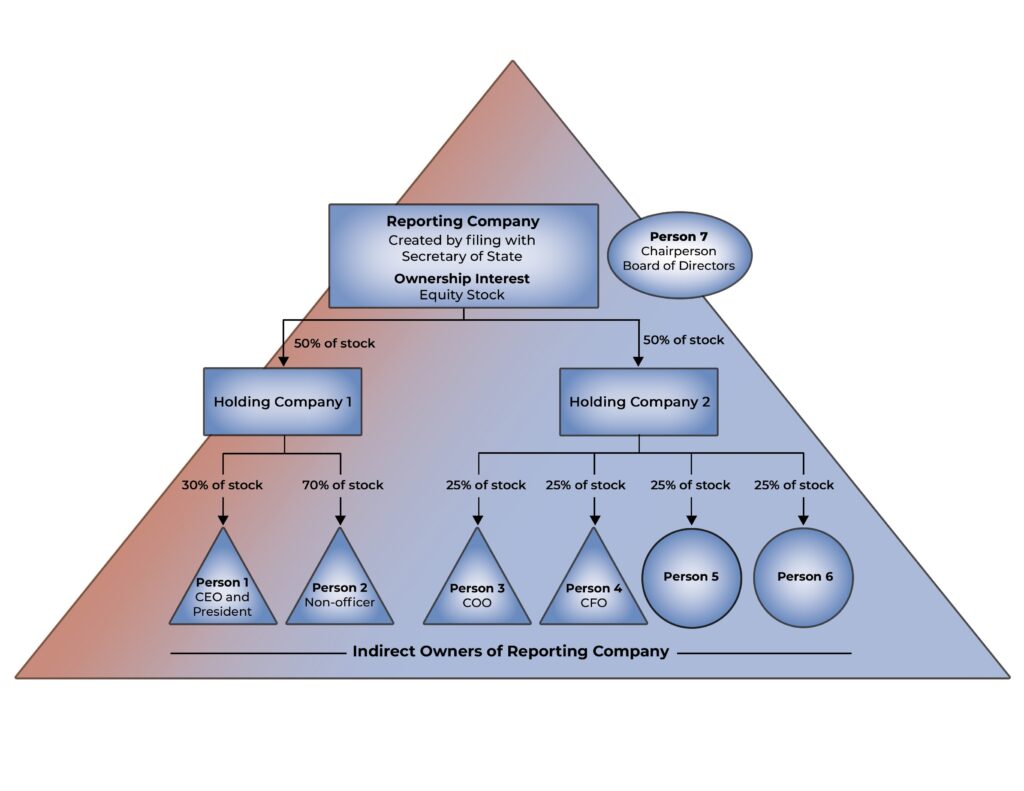

All domestic or foreign entities that register with a state Secretary of State office in the United States (or similar office under the law of a State or Indian Tribe) may be subject to the CTA reporting obligations. The CTA applies to corporations, limited liability companies, partnerships, limited partnerships, certain trusts, and disregarded entities. A company subject to the CTA is known as a “Reporting Company.” (31 U.S.C. §5336(a)(11)(A))

There are twenty-three (23) enumerated exemptions whereby such entities are not subject to the CTA and therefore are not a Reporting Company. (31 U.S.C. §5336(a)(11)(B))

What Entities are Exempt from CTA Compliance?

|

1. Securities Issuer |

13. State-Licensed Insurance Producer |

|

2. Government Authorities |

14. Commodity Exchange Act Registered Entity |

|

3. Banks |

15. Accounting Firm |

|

4. Credit Union |

16. Public Utilities |

|

5. Depository Institution Holding Company |

17. Financial Market Utility |

|

6. Money Services Business |

18. Pooled Investment Vehicle |

|

7. Broker or Dealer in Securities |

19. Tax-Exempt Entities |

|

8. Securities Exchange or Clearing Agency |

20. Entity Assisting Tax-Exempt Entity |

| 9. Other Exchange Act Registered Entity | 21. Large Operating Company |

| 10. Investment Company or Investment Advisor | 22. Certain Exempt Entity Subsidiaries |

| 11. Venture Capital Fund Adviser | 23. Inactive Companies |

|

12. Insurance Company |

What information does a Reporting Company need to report?

Reporting Companies must disclose their business name, any assumed names (e.g., trade names or “dbas”), state of formation, and principal business address and its federal employer identification number.

What information does a Beneficial Owner need to report?

Each Beneficial Owner of the Reporting Company has to report the following BOI to FinCEN:

- Full legal name

- Date of birth

- Residential address

- Unique identifying number (e.g., driver’s license, passport number, or FinCEN number)

- Scanned copy of the identifying document

- For entities formed on or after January 1, 2024: information for up to two company applicants (individuals who file the formation documents) is also required. (31 U.S.C. §5336(b)(2)(A))

Who is a Beneficial Owner?

A beneficial owner is any individual who, directly or indirectly, exercises “Substantial Control” over a Reporting Company or owns at least twenty-five percent (25%) of the Reporting Company’s ownership interests. (31 U.S.C. §5336(a)(3)(A))

What is Substantial Control?

As explained in FinCEN’s FAQ D.2., a person who exercises Substantial Control generally means any of the following:

- Persons with senior officer titles and responsibilities (e.g., CEO, CFO, COO, GC);

- Persons with authority to appoint a majority of directors;

- Persons with authority to appoint or remove senior officers;

- Persons with majority or controlling authority of the company’s board

- Persons who make important business decisions (e.g., nature, scope and attributes of the business, selection or termination of business activities, selecting geographic focus, executing significant contracts, exercising financial control, authority over reorganizations, M&A activities, or amending governing documents); or

- Persons who exercise any other type or form of Substantial Control.

How are Subsidiaries Treated for the CTA?

The treatment of subsidiaries will depend on the facts and circumstances of how the subsidiary is owned by its parent company and what exemptions may apply to the parent. For example, if a subsidiary is wholly owned by an exempt company, the subsidiary will likely not have to report its BOI, but rather will only have to report that it is owned by an exempt entity. The subsidiary will have to report the name of the exempt parent company. (31 U.S.C. §5336(a)(11)(B)(xxii) and §5336(b)(2)(B). See also FinCEN FAQ #22)

How does the Large Company Exception Work?

An entity will qualify for the large company exception if ALL six (6) of the following criteria are satisfied:

- The entity employs more than twenty (20) full-time employees;

- More than twenty (20) full-time employees are employed in the United States;

- The entity has physical operating presence in the United States;

- The entity has filed a Federal income tax or information return showing more than $5,000,000.00 in gross receipts or sales;

- The entity reported more than $5,000,000.00 as gross receipts or sales (net of returns or allowances) on the entity’s IRS Form 1120S, consolidated Form 1120, IRS Form1120-S, IRS Form 1065, or other applicable IRS Form; and

- The $5,000,000.00 threshold discussed above is applicable to domestic (U.S.) revenues. (31 U.S.C. §5336(a)(11)(B)(xxi)

What is an Inactive Company?

An entity will qualify of the inactive company exception if ALL six (6) of the following criteria are satisfied:

- The entity was created on or before January 1, 2020;

- The entity is not engaged in any active business;

- The entity is not owned by a foreign person;

- The entity has not had any change in ownership in the preceding twelve (12) months;

- The entity has not sent or received money in an amount greater than $1,000.00 in the preceding twelve (12) months; and

- The entity does not have any assets. (31 U.S.C. §5336(a)(11)(B)(xxiii)

When does a Reporting Company need to comply with the CTA?

Existing Reporting Companies have one (1) year to comply. That is, any entity formed before January 1, 2024, must file their initial report on or before December 31, 2024.

New Reporting Companies have ninety days (90) days to comply. That is, any entity formed on or after January 1, 2024, but before January 1, 2025, must file their initial report within ninety (90) days of formation.

Reporting Companies formed in 2025 and thereafter will have just thirty (30) days to comply. That is, any entity formed after December 31, 2024, must file its initial report within thirty (30) days of formation.

CTA compliance obligations are ongoing. Any change to any to a Beneficial Owner’s information must be reported to FinCEN within thirty (30) days of the change.

(see generally, (31 U.S.C. §5336(b)(1)

What are the penalties for non-compliance with the CTA?

FinCEN may impose both civil and criminal penalties for failure to comply. Civil penalties may be up to five hundred dollars ($500) per day. Criminal Penalties include fines of up to ten thousand dollars ($10,000) and up to two (2) years in prison. CTA reporting obligations must be taken seriously. (see generally, 31 U.S.C. §5336(h)(3))