The Corporate Transparency Act (“CTA”) took effect on January 1, 2024, and with it comes new federal reporting requirements for many business owners across the United States. Unfortunately, the introduction of the CTA has provided scammers with a new opportunity to prey on unsuspecting business owners, many of whom are unfamiliar with the CTA’s compliance process.

Scammers are sending business owners CTA solicitations under the guise of government offices in order to collect and use individuals’ personal information, nefariously.

A typical scam comes in the form of a letter or email entitled: “Important Compliance Notice.” The notice will urge the individual to visit a link or scan a QR code to provide information that will satisfy his/her compliance obligations under the CTA. Likely, the communication will be sent from an entity posing as a government office or compliance division. The Better Business Bureau (“BBB”) warns that the communication may come from “the United States Business Regulations Department, Corporate Transparency Act Division, Process and Filing Center” or some similar bogus office. These communications are fraudulent.

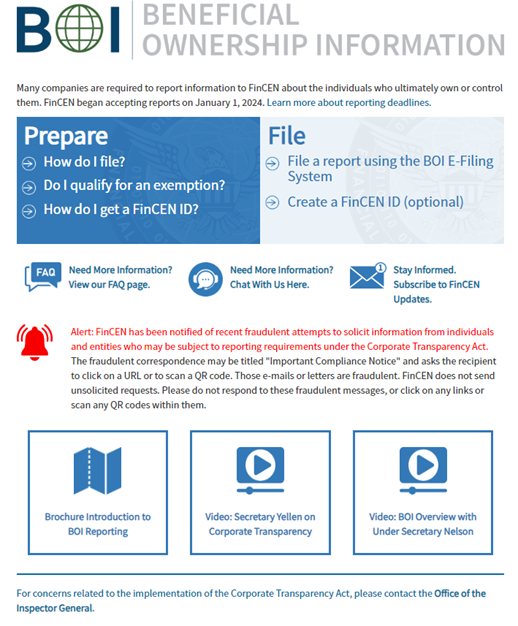

The U.S. Department of Treasury’s Financial Crimes Enforcement Network (“FinCEN”) is the proper entity that administers the CTA compliance process; FinCEN will NEVER send unsolicited requests to businesses or individuals requesting information.

The BBB further warns that scammers will often address the correspondence to the business and include a notice number, watermarks, official seals, or known personal information to make the solicitation appear legitimate. Remember, a scammer’s goal is to confuse an individual into giving their personal information. PLEASE DO NOT FALL VICTIM TO THESE SCAMS!

FinCEN has issued a warning regarding CTA scams on the Beneficial Ownership Information reporting homepage (Image below).

Protect yourself and others from CTA scams by taking the following steps:

- Disregard. If you receive a CTA solicitation from an unfamiliar source in the mail or in your email inbox, do not engage with the correspondence. Do not visit the website, scan the QR code, or click on any links.

- Verify. If the communication you received seems suspicious, but you still aren’t sure whether it may be legitimate, look up the official government office and call its official phone number (not using any of the contact information provided on the suspicious communication) in order to verify whether the government contacted you.

- Report. If the solicitation is, in fact, a government imposter scam, you can report it to BBB’s Scam Tracker or via the Federal Bureau of Investigation’s (“FBI”) Internet Crime Complaint Center.

- Contact a Professional. If you are unfamiliar with the CTA or the reporting obligations that your business may face under the new law, contact a trusted advisor. Hahn Loeser and Parks has a dedicated taskforce of legal professionals who understand the intricacies of corporate compliance and are ready to assist clients with the CTA.

Stay vigilant against such fraud and keep up to date with the latest CTA developments by visiting the Hahn Loeser and Parks Corporate Transparency Act Hub.

FinCEN Warning